Overview

1,2,3 BHK starting at 50 Lakhs*

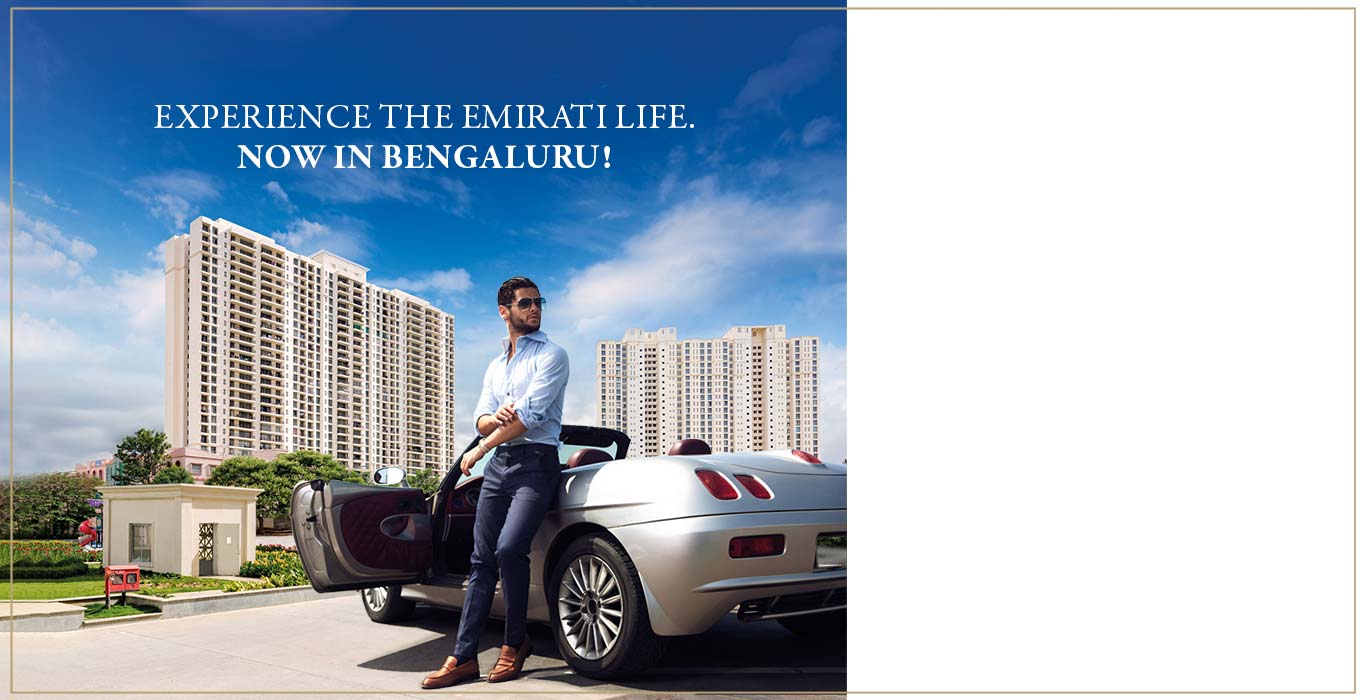

House of Hiranandani

Since our inception into India’s urbane terrains, we have upturned the way living spaces are designed. And with that,

we have transformed the ethos and aesthetics of real estate. We have launched a number of projects that offer luxury homes.

From picturesque projects in Bengaluru, to the breath-taking community in Chennai, OMR and spacious residential plots in Shankarpally;

we’ve built integrated communities to give Indian buyers the true taste of luxurious living.

Best Integrated Township of the year,

OMR Community by Times Network.

Best Residential Building award,

Hill Crest, Bannerghatta, Bengaluru by Times Network.

© Copyright 2000- House Of Hiranandani. All Rights Reserved.

Privacy Policy | Disclaimer: The above mentioned price is excluding other charges and statutory payments. The images shown are for Illustration purposes only and may not be an exact representation of the product. The layout details, amenities and facilities mentioned or shown are subject to changes or relocation within the composite development and are subject to modification, amendment or changes, without any prior notice, at the sole discretion of the Developer.

*Conditions apply.

By using or accessing the website, you agree to the Disclaimer without any qualification or limitation. All the information including brochures, images, designs, specifications, project details, plans, marketing collaterals and other information that are available on this website are solely for informational purpose only & are indicative in nature and the visitor has not relied on this information for making any booking/purchase in any project of the Company. Visitors are therefore requested to directly verify all details and aspects of any proposed booking/acquisition of units/premises, directly with our authorised representatives.

The company under no circumstance will be liable for any expense, loss or damage including, without limitation, indirect or consequential loss or damage, or any expense, loss or damage whatsoever arising from use, or loss of use, of data, arising out of or in connection with the use of this website.

We thank you for your patience and understanding.

The RERA details are available on the website www.tnrera.in or www.rera.karnataka.gov.in under registered projects

Information on TDS

The Finance Act, 2013 introduced a new section 194IA, which mandates tax withholding of 1 percent (1%) by the transferee (i.e. Buyer) on credits or payments (whichever is earlier) made to a transferor (i.e. seller) in relation to the transfer of immovable property, being land (other than agriculture land) or a building or part of the building, if the consideration for such a transfer of property is Rs 50 lacs or more. The said section is effective from 1st June, 2013.

In light of the above, the buyer is required under Section 194 IA of the Income Tax Act, 1961, to deduct the withholding tax of 1 percent (1%) in respect of credits or payments made to the seller, whichever is earlier, from 1st June, 2013 and deposit the same with the statutory authorities and produce the copy of the challan to the seller for its records. The credit of the amount so deposited would be given to the buyer only when the seller has ensured that the tax so paid has been correctly reflected in 26AS Statement of the Company.

For the PAN number of your seller, and in this case, the Company through which a contract for transfer of immovable property has been entered into, please contact your relationship manager, or customer service agent.

To know more about the Section 194 IA of Income Tax Act 1961, and to pay the tax through e-payments, please follow the link mentioned below which will help educate you on the process and steps to be followed to make tax payments online.

http://www.slideshare.net/swetasingh89/e-tutorial-tds-on-property-22598141